The Korean art market surpassed 900 billion won last year, according to the 2021 Korean Art Market Settlement by the Korea Arts Management Service. In 2020, when COVID-19 began, the art market fell 13.7%. However, in 2021 the art market expanded 2.8 times compared to 329.1 billion won in 2020. It is because the craze for art investment is growing in Korea. The public participation in art auctions grew from 2021. The distance between society and art has become closer. Do Hyun-soon, CEO of K-Auction, said, "The investment craze has expanded to the art market along with liquidity enriched by COVID-19." The decisive factor that lowered the threshold of entry into the art market is the participation of the Generation MZ.

How did art investment gain popularity in Generation MZ?

There are several reasons why Gen MZ suddenly became interested in art investment. First, Gen MZ is familiar with the digital world. Before COVID-19, artists who did not belong to a gallery began to seek distribution channels online. However, the pandemic has changed the major consumer class itself as auction companies have increased online auctions and even boosted the investment craze for Gen MZ. In fact, the proportion of online transactions that Gen MZ uses for most of its purchases jumped to 25%, double from 2020, according to the World Art Market Report by Art Basel and UBS financial services.

According to Art Economics, a consulting firm specializing in the art market, millennials accounted for 64% of the world's richest collectors in the first half of last year, and their total spending on artworks averaged $378,000 per collector, the highest among all generations. The amount more than doubled from 2019 and 2021, much higher than that of Generation X, which spent an average of $118,000 per collector and nearly four times as much as baby boomers.

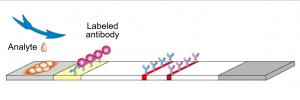

Another key to the popularity of art investment is that it is possible to make a small investment. In the past, artworks were the domain of wealthy people, but they are attracting the attention of people in their 20s and 30s as small investments are possible. It is a way for investors to share ownership of expensive works and earn profits. Pika Project operates a joint platform for artworks using blockchain technology. Art shares are received and stored in the blockchain server, depending on the number of investments. Shinhan Bank recently joined hands with Seoul Auction Blue, an online auction house, to open a joint purchase platform called 'SOTWO.'

Last year, about 3,500 new members of the Seoul Auction were in their 30s, and demand for the work of young artists also increased significantly. Unlike older collectors who mainly listen to expert advice when purchasing art, Gen MZ collectors tend to choose artwork that suits their tastes. This is the effect of having their own taste as they are exposed to the works of artists who promote themselves through SNS.

Pros and Cons of the Artistic Investment Trend Led by Gen MZ

Art investment is an opportunity for many people to become interested in art collections. Artworks can generate money from copyright income, image rental fees, and exhibition profits. Usually, art investment’s profits are about 12% per year, which is significantly different compared to the average of 2.2% from commercial banks. For example, if a bank makes 2.2 million won a year on the investment of 100 million won, it would generate 12 million won a year in profits through art investment. Therefore, art investment serves as an opportunity for many people to be interested in art collections. But the greatest joy of art investment is the aesthetic satisfaction, aesthetic value, and artistic experience that the owner of the work can experience.

The disadvantage of art investment technology is that related laws are still underdeveloped in terms of consumer protection. The art joint purchase platform has emerged as a new player that opened the art market to the public. Through the division of ownership, it is possible to invest in small amounts by dividing expensive art among many investors and then reselling it. However, since this is not a financial product under the Capital Markets Act, questions remain about consumer protection. In addition, Korea's art market is focused on the works of a very few famous artists. There should be policy support to encourage art collection so that it can lead to a virtuous cycle of hiring professionals, creating growth opportunities for art-related companies, and protecting the consumers.

Hyunrim Kim arnoldkim123@naver.com

<저작권자 © 홍익대영자신문사, 무단 전재 및 재배포 금지>